If I’m reading your comment right, you might be talking about gauging for inspection purposes, but that’s not what OP has here. I’d call it more of a printer calibration block.

- 1 Post

- 16 Comments

322·7 days ago

322·7 days agoNot really. See table 2 here (a ways down the page)

Cold generally slows degradation.

But using them at cold temps is bad

13·1 month ago

13·1 month agoA drone operator usually is not standing directly under the drone, so no. Or alternately, the drone if probably further away from you horizontally than vertically during most of its operation.

One interesting thing here is that, for a given altitude, the antenna gain will be higher the further away the drone is.

2·1 month ago

2·1 month agoWould Molex Mini-Fit work for you?

1·1 month ago

1·1 month agoDang 10A is kind of beefy, what is this for?

Do you need IP rating?

If you didn’t need 10A I would have recommended M12 connectors

54·2 months ago

54·2 months agothey get audited, at least, yearly by law

The IRS doesn’t audit annually, companies hire 3rd party auditors. And it’s not a tax requirement, it’s a public-company requirement.

12·2 months ago

12·2 months agoYes there is a difference, but LLC is a legal concept, not a tax one. The IRS taxes sole proprietors the same whether or not they have an LLC.

Tax entities include sole proprietorship (default), partnerships, s corps, c corps. Any of those can be LLCs, but they don’t have to.

12·2 months ago

12·2 months agoProfitability is just a proxy for whether someone is legitimately running a business, or just trying to save money on their hobby. Businesses can deduct expenses, hobbies cannot.

So if you are running an etsy store or an engineering company and buy a 3d printer to make parts, the cost of that 3d printer is subtracted from revenue for tax purposes. If your “business” is actually a hobby, it’s not legally a business expense and therefore it’s not deductible

(In the USA)

10·8 months ago

10·8 months agoI see “taxes” a lot but I have never seen someone explain the mechanism by which this is supposed to work.

The only thing I can come up with in my head is that they have capitalized the development costs and are currently depreciating the resulting asset. And that by cancelling/delisting the games it may allow them to immediately depreciate the rest of it, thereby recognizing a large expense for the current tax year, reducing profit, and therefore taxes.

Is that how this is supposed to work?

8·9 months ago

8·9 months agoYeah Tildes is exactly what OP is looking for. It was designed from the start to facilitate discussions and suppress memes

1·1 year ago

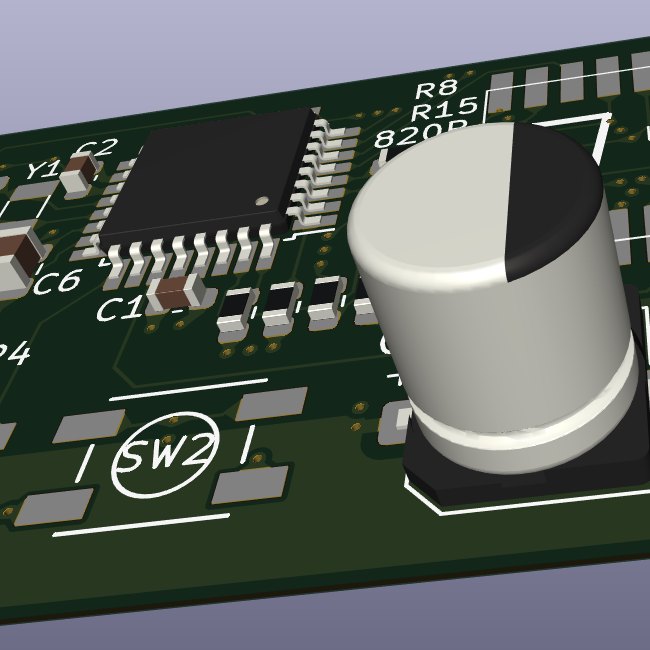

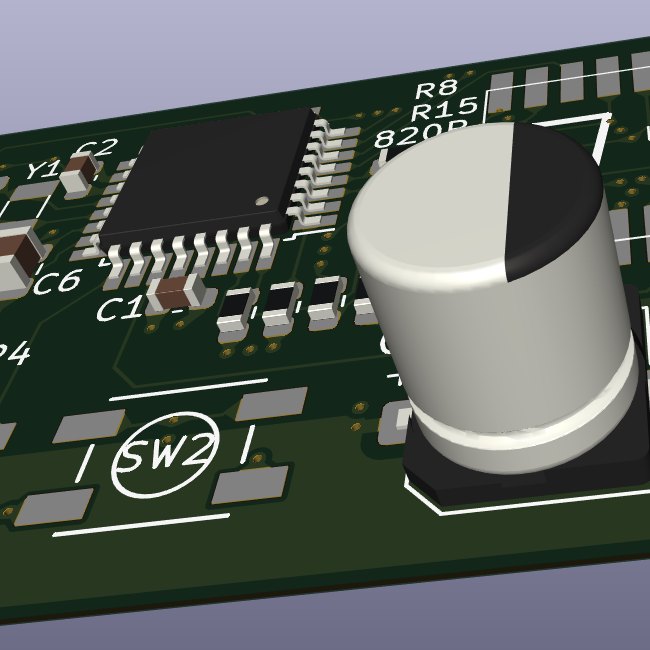

1·1 year agoI’m actually building my own current measurement tool for this reason. Maybe I can post my design up and see if its useful to you?

I’d be very interested! I am considering building my own little box for this too.

1·1 year ago

1·1 year agoI swear I remember seeing the uCurrent before and TBH that’s probably what unconsciously inspired most of my wishlist. Thanks for the reminder. Seems to be unavailable (out of stock) currently…and I kind of wish it had a greater range. I’m semi-inclined to make my own.

For my immediate purposes I just ordered a few INA169 breakouts which will work well enough.

11·1 year ago

11·1 year agoThis comment is very human

13·1 year ago

13·1 year agoAre you familiar enough with the details to share them? Because this sounds strange to me - every plan has an out of pocket maximum and the highest I’ve seen is $14k. Are you including premiums? Do the costs span multiple years?

25·1 year ago

25·1 year agoSure, the marginal cost is basically nothing. Once you have invested billions in infrastructure.

Not saying 10 cents isn’t outrageous, just that 0.001 cents seems low

Wow dude I was trying to be helpful. That’s why I replied.